Table of Content

We understand you have questions and we’ve got answers. So, let’s get you a home loan that will make you comfortable. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes.

As long as you don’t go over your limit, the money will be there to pay for whatever you need.

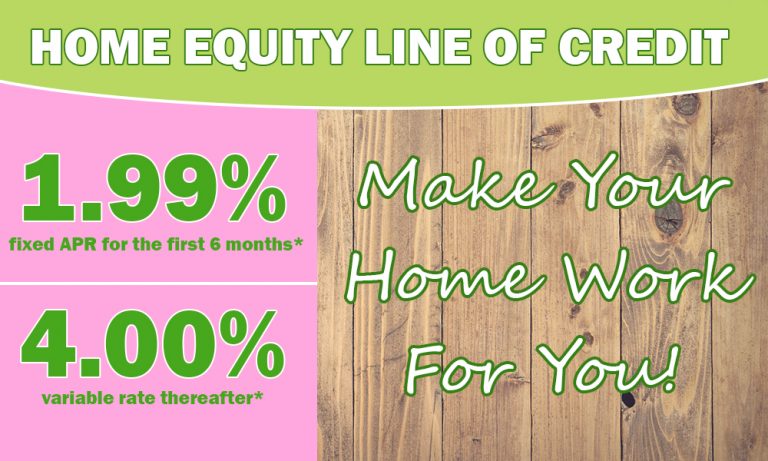

Sometimes you need to stay flexible. Lines of credit can help.

There are typically no closing costs and a quicker approval process when you open a HELOC. We’ve got the products and services you need to meet your savings goals. Whether it’s CDs, Money Market Accounts, Christmas Club Accounts or Health Savings Accounts. Whether you’re a first-time homebuyer or a long-time homeowner, applying for a mortgage is intimidating.

Even though you don’t necessarily take on an additional loan with a cash-out refinance, you’ll still increase your overall debt load and pay closing costs. Home improvement loans from Pinnacle Bank allow you to quickly upgrade or maintain the quality and value of your home – your largest investment! Different from a home equity line of credit, home improvement loans aren’t tied to the equity in your home. It is a personal loan, with terms and rates primarily determined by your credit score. If you plan to start your own business, or you’d like to invest in a property or other business venture, using your home’s equity may be an excellent way to do so.

Loan Calculator

But when you use your home’s equity in a way that gives you a positive return for your future, you’ll maximize your investment and potentially save money as well. At Pinnacle Bank, our goal is to provide the best financial services to you and your family. You can refinance your mortgage for a higher amount (based on your home’s equity) and take out the difference in cash.

We offer a wide variety of loan options to meet your specific needs and financing requirements. It all begins by connecting with us and sharing your plans. Then we partner with you to find the perfect option. Just be sure any improvement you make using the equity in your home adds value to it. Common examples include remodeling your kitchen, installing solar panels, adding energy-efficient windows, or upgrading the exterior siding on your home.

Checking Accounts

Pinnacle Bank isn't responsible for or endorse any information provided by the website you are about to enter. Keeping your cash flow rolling along is essential for running a small business and for your own peace of mind. Pinnacle Bank has been a locally owned, community bank since 1934. We specialize in meeting our customers’ financial needs, both now and into the future. They can walk you through it and let you know quickly if it’s been approved.

And when you make home improvements, choose the options that are best suited for your home — you wouldn’t put a $50,000 gourmet kitchen in a $200,000 home . Get a FREE gift when you open any Pinnacle Bank Checking Account. No hassle, no fuss, just a basic checking account with which to deposit and withdraw funds. The site you have chosen is independent from Pinnacle Bank/Bank of Colorado. We do not control external sites, and we cannot guarantee the accuracy, completeness, efficacy or timeliness of the information contained therein. JavaScript is required for this calculator.

The more your home is worth, the larger the line of credit. Of course, the final line of credit you receive will take into account any outstanding mortgages you might have. This includes first mortgages, second mortgages and any other debt you have secured by your home. Pinnacle Bank has always been and always will be focused on personal service. Our experienced loan officers are available to answer your questions, whether they are regarding auto loans or any of our other types of loans. Pinnacle Bank puts the “personal” in personal loans.

The equity you’ve built with your house can be put to good use. Whether you prefer a loan or a line of credit, we make qualifying easy so you’ll have the money in your hands fast. Use this calculator to determine the home equity line of credit amount you may qualify to receive. The line of credit is based on a percentage of the value of your home.

If you are using Internet Explorer, you may need to select to 'Allow Blocked Content' to view this calculator. This site is best viewed in an up-to-date web browser with JavaScript enabled. When tied to your checking account, the line of credit can save you from the fees and embarrassment of coming up short. This line of credit is secured by the equity you have in your home. Pinnacle Bank's terms, privacy and security policies do not apply to the site you're about to enter. Please review its terms, privacy and security policies to see how they apply to you.

Use care in how much you invest because of the risk involved — your home is the collateral. Typically, you should invest no more than 80% of your home value for this purpose. With a loan, you’re taking out money one time and paying it back over a few years. Rather than a set amount, you’re using the equity in your home to open revolving credit. You can borrow money with this Line of Credit multiple times.

Many people like this type of account for unexpected expenses, rather than using a higher interest credit card. Lines of Credit give you the comfort of knowing you have cash ready when you need it. With this type of loan, you borrow against the available equity in your home, using your house as collateral for a line of credit. As you repay your outstanding balance, the amount of available credit is replenished . Use the funds as you need them and only pay interest on the portion of the credit line you use.

A line of credit is a simple financing tool built around flexibility. Instead of giving you a lump sum of money to spend, it keeps money available for you to draw on whenever you need it. It’s perfect for projects and purchases where costs can be unpredictable.

Home Improvement Loans

If one of these sounds like the right fit for you, apply using the links above. We accept online applications from residents of Tennessee, North Carolina, South Carolina and Virginia. You don’t need to use your home or other assets to borrow money. You can use your line of credit all at once or a little at a time. You also have the flexibility to borrow different amounts at different times, and your monthly payment may vary. Lines of credit allow you to be more flexible in your personal finances and give you more flexible repayment terms.

No comments:

Post a Comment